Quarterly Annuity Update

Q4 2025: Finishing Strong with Savings and Strategic Placements

As of December 31, 2025, our annuity team delivered another strong year of results, successfully placing 91 annuity contracts totaling $2.4 billion and representing over 28,000 lives. Of these placements, 52% supported clients’ ongoing de‑risking strategies while 48% facilitated full plan terminations, demonstrating our continued leadership across both transaction types. Notably, total savings for our annuity clients rose to 3.2% in 2025 reflecting our team’s strong premium negotiation skills and insurance carrier relationships.

Pension Plan Landscape & Industry Trends — Pension Risk Transfer

Pension risk transfer strategies help plan sponsors reduce financial exposure by shifting pension liabilities to an insurance company. A buy-out is a standard contract in the industry, transferring assets and liability from the plan sponsor to insurance company. A buy-in locks in future buy-out pricing with no accounting settlement. The assets and liabilities are maintained within the plan and held in a contract with the insurance company.

U.S. Pension Risk Transfer sales volume continues to decline in Q3 2025

Single premium Pension Risk Transfer YTD 2025 sales in U.S. down 48% compared to 2024.

| $20.6 Billion in U.S. Pension Risk Transfer sales YTD 2025 | Volume of 441 U.S. Pension Risk Transfer contracts YTD 2025 |

|

|

Sources: LIMRA Group Annuity Risk Transfer Sales Survey (Dec 2025); LGRA Pension Risk Transfer Monitor (Q3 2025)

Observations from USI Consulting Group Annuity Placement Practice

| Contract Volume in 2025 similar to last two years but Average Contract Size doubled in 2025 |

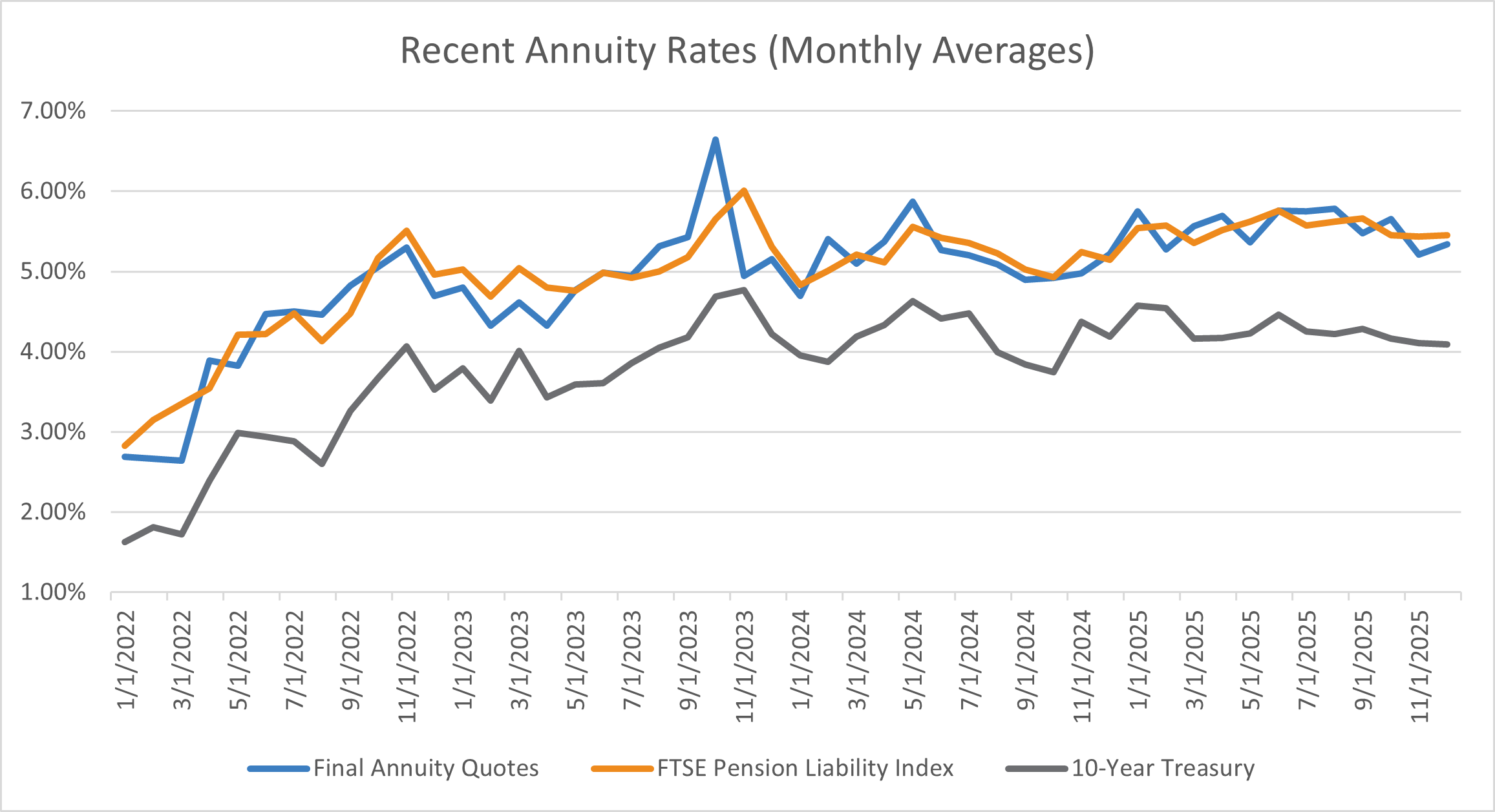

Pricing remains favorable at year-end with effective rates above 5% |

||

| Transactions split evenly among plan termination and partial plan carve-outs |

Greater competition among carriers in 2025 |

Pension Plan Landscape & Industry Trends — Returns

EQUITIES ROSE IN Q4 2025 |

INTEREST RATES FALLING IN Q4 2025 |

|

|

|

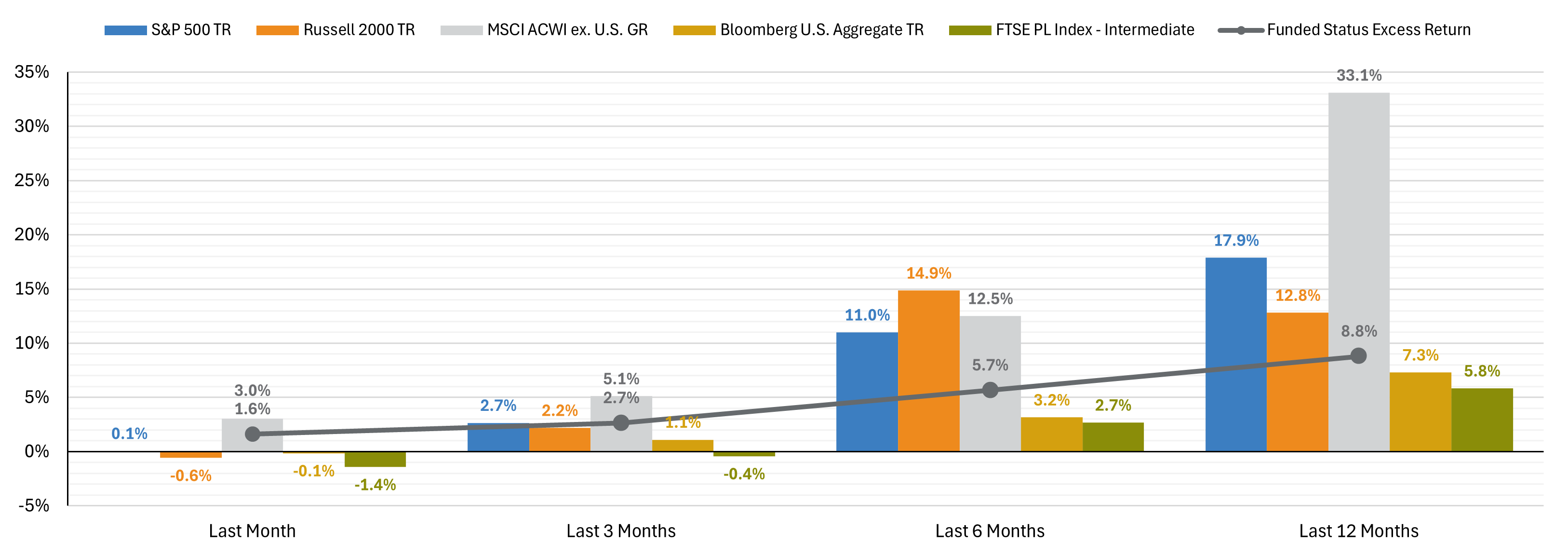

Strong equity market gains in Q3 2025 positively impact defined benefit (DB) pension plans by boosting asset values, which can improve funded status and reduce future contribution requirements. With U.S. large caps up 8.1%, small/mid caps up 12.4%, and international equities up 7.0%, plans with diversified equity exposure likely saw meaningful growth. This may also create opportunities for de-risking strategies, such as pension risk transfers, and can lower pension expense on corporate financial statements. |

Falling interest rates in Q3 2025 negatively impact defined benefit (DB) pension plans by increasing the present value of future liabilities. As Treasury yields declined—2-Year by 12 basis points, 10-Year by 8 basis points, and 30-Year by 5 basis points—discount rates used to value pension obligations likely fell as well. This leads to higher reported liabilities, which can reduce funded status even if plan assets performed well. Sponsors may face increased balance sheet volatility and higher pension expense, especially if asset growth doesn’t offset the liability increase. |

PENSION PLAN FUNDED STATUS IMPROVED IN Q3 2025 |

CREDIT SPREADS HAVE NARROWED |

|

|

|

Improved funded status in Q3 2025 reflects strong asset performance relative to liability growth. A typical pension plan with a 60/40 equity-to-fixed income allocation saw assets increase by 6.0%, driven by gains across U.S. and international equities and bonds. Meanwhile, liabilities—based on a duration of 13–14 years—rose 3.1% due to falling interest rates. The excess asset return of 286 basis points over liabilities strengthens the plan’s funded status, potentially reducing future contribution needs and creating opportunities for de-risking or pension risk transfer strategies. |

Narrowing credit spreads in Q3 2025, reflected by a 13-basis point drop in the FTSE Pension Liability Index (from 5.58% to 5.45%) and its intermediate counterpart (from 5.46% to 5.33%), increase the present value of pension liabilities. For defined benefit (DB) plans, this means higher liability valuations, which can negatively affect funded status if asset growth doesn’t keep pace. Sponsors may see increased pension expense and greater balance sheet volatility, especially for plans using corporate bond yields to discount liabilities. |

Sources: Morningstar, U.S. Treasury, FTSE Pension Liability Index Report. Data as of September 30, 2025.

Pension Plan Landscape & Industry Trends — Monitoring

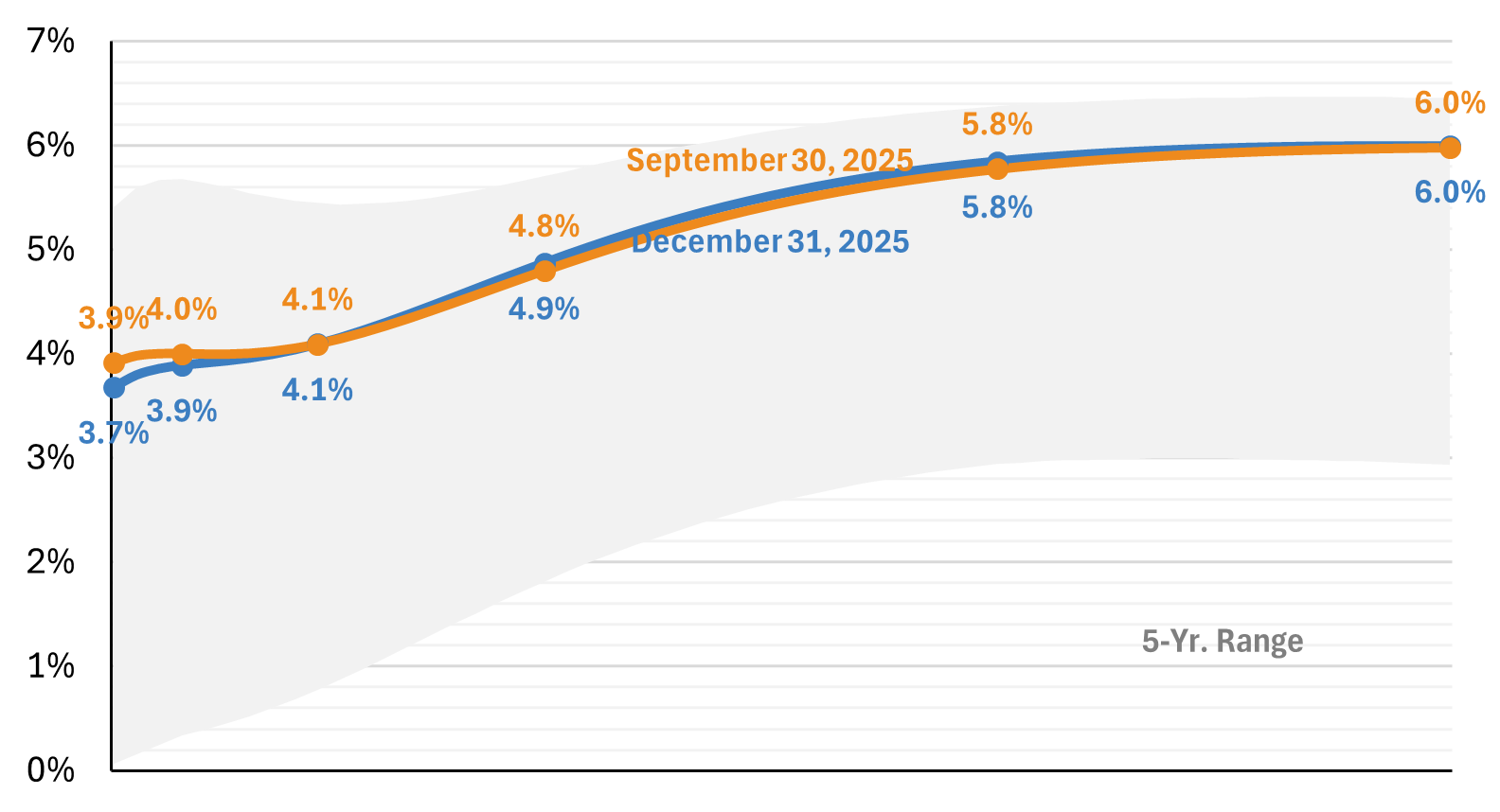

PENSION LIABILITY INDICES |

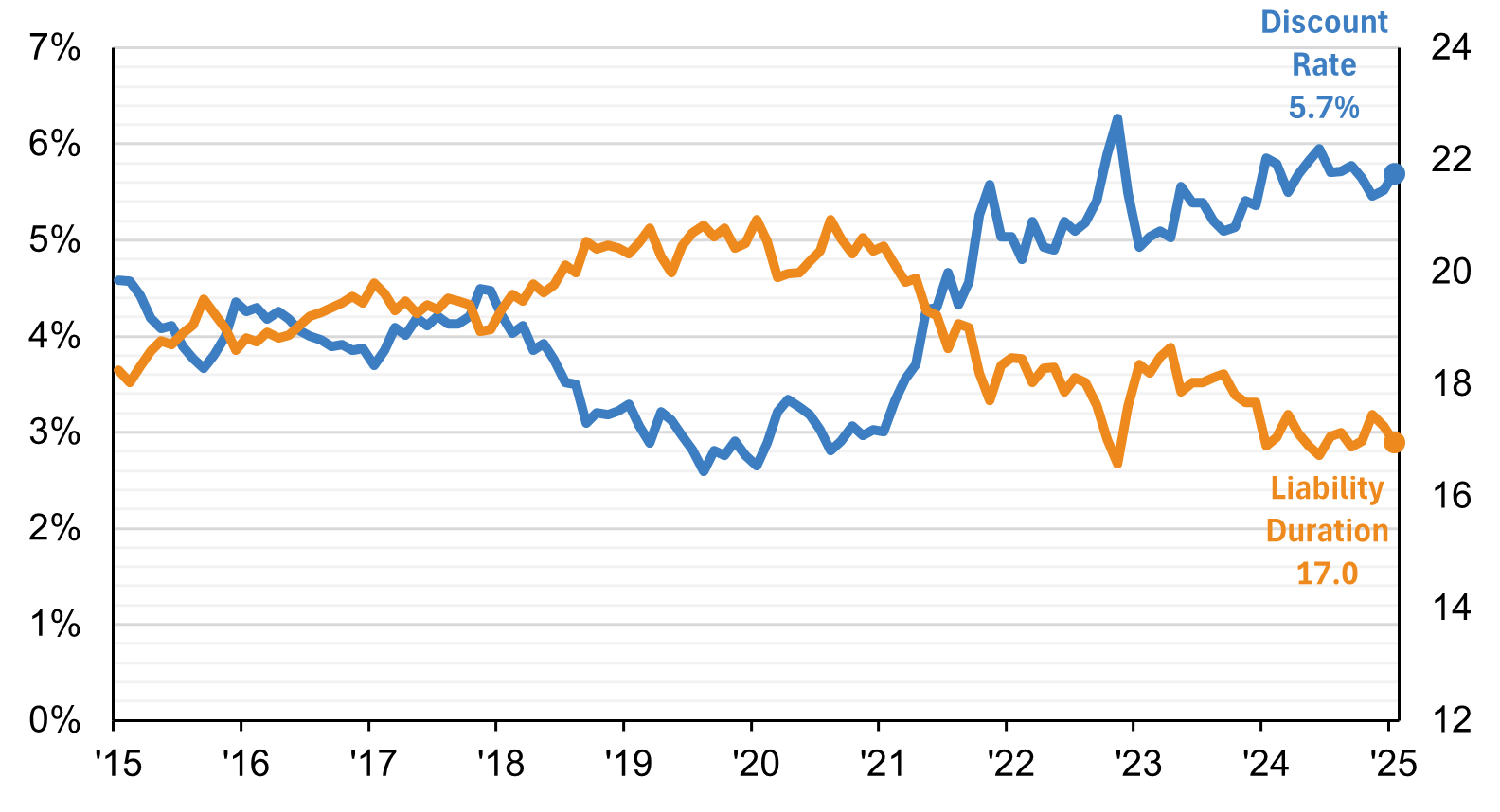

PENSION LIABILITY CURVE |

|

This chart tracks the Discount Rate and Liability Duration from 2016 to 2025. It highlights how interest rate changes and liability durations impact pension obligations over time. A rising discount rate typically reduces liabilities, while longer durations indicate greater sensitivity to rate changes which are key metrics for monitoring plan health. |

This curve compares pension liabilities across different maturities (6 months to 30 years) at two points in time: March and June 2023. It shows how liabilities shift with changes in the yield curve, helping plan sponsors understand the timing and magnitude of future obligations. |

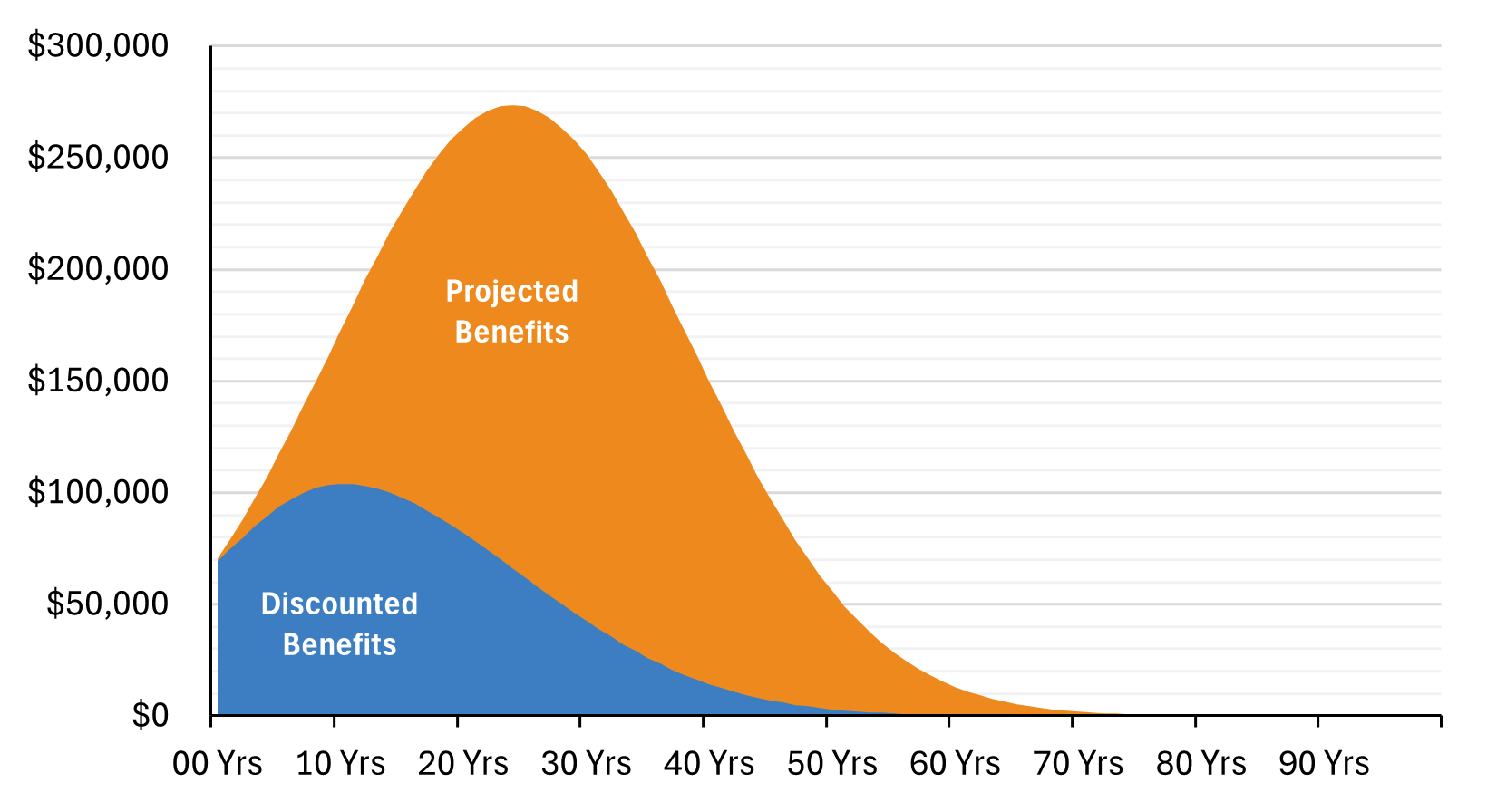

INDEX MODEL LIABILITIES |

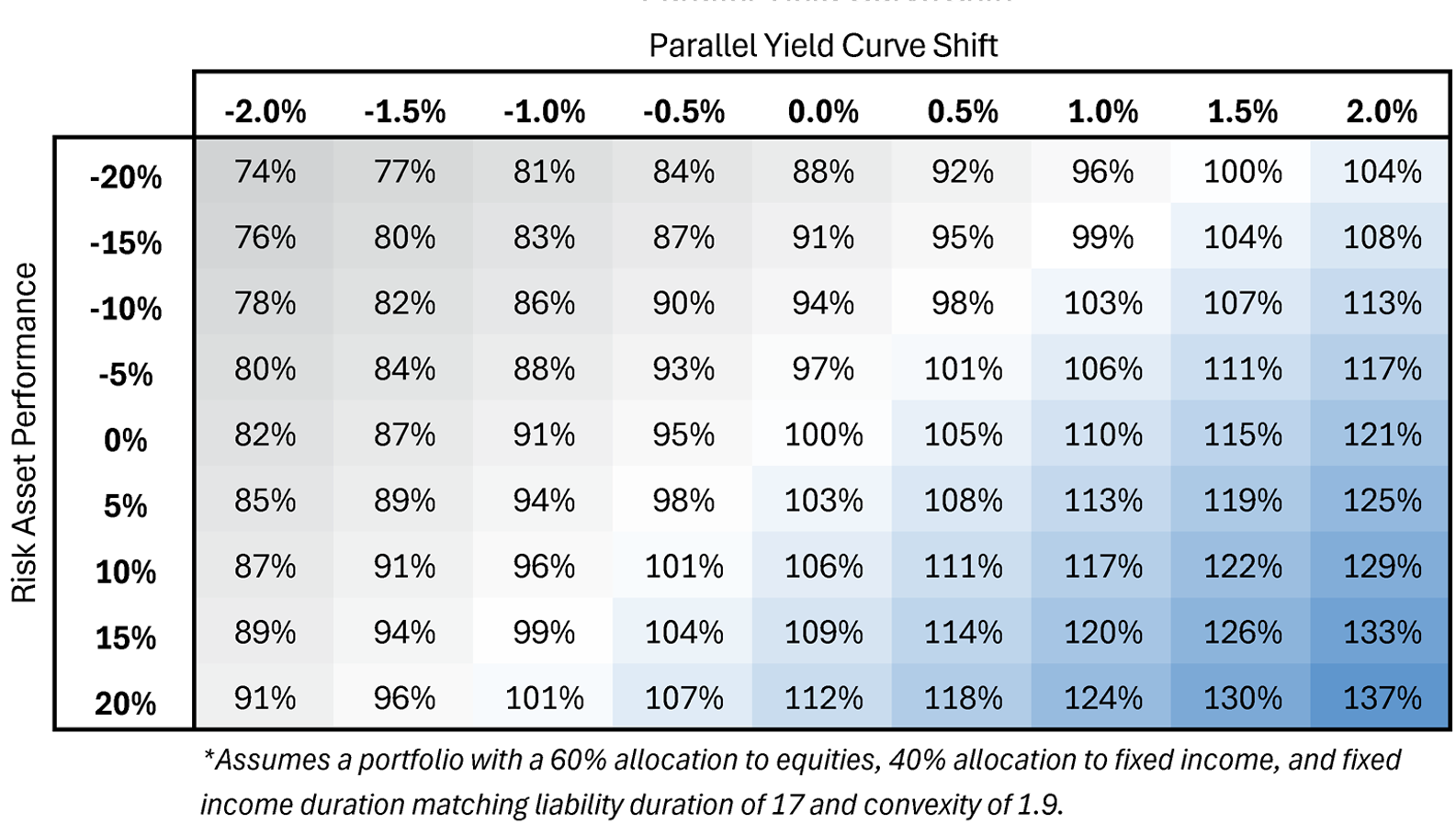

FUNDED STATUS SENSITIVITY |

|

This chart contrasts projected benefit payments with their present value across a 90-year horizon. It visualizes the long-term financial commitment of pension plans and the impact of discounting future benefits essential for evaluating funding strategies and sustainability. |

This chart helps plan sponsors understand how interest rate and market changes affect liabilities and funding levels which is critical for risk management and strategic planning. It shows how a pension plan’s funded status reacts to both shifts in the yield curve (which impacts both the fixed income portion of the portfolio and the plan liability), ranging from -2.0% to +2.0% and changes in equities, ranging from -20% to +20%. Blue cells indicate improved funding (typically from rising rates), while gray cells show deterioration (from falling rates). For example, if equities remain constant, but the yield curve shifts +2%, the change in the fixed income portion of the portfolio and the plan liability will increase the funded status from 100% to 116%. If the yield curve remains constant, but equities improve 5%, the funded status would improve from 100% to 103%. |

Sources: USI Consulting Group. Data as of December 30, 2025.

How USI Consulting Group can help

At USI Consulting Group, we are pleased to offer the opportunity to purchase single premium annuity contracts through a menu of quality insurance carriers. Our actuaries and annuity product consultants are trained to assist clients on the merits and/or limitations of a single premium annuity purchase for their specific cases. Our proactive consulting by an integrated team can provide savings that exceed an individual de-risking strategy. To learn how we can help you, please reach out to us at information@usicg.com.

Investment advice provided to the Plan by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. Both USI Advisors, Inc. and USI Securities, Inc. are affiliates of USI Consulting Group. | 22126.S0126.99002

Not receiving our newsletter?

Stay up to date with retirement plan updates and insights by subscribing to our email list.